Tips to Manage Payroll in Odoo 13

The employees having remuneration payments in a company must be managed and provided with utmost care. Every month’s salary calculations are provided with various parameters set by the company. It is based on the leaves, the company approved vacations and time off days.

When the salary is due every month the company tracks work entries, duties and attendance performed by the employee for the respective month.

The company is liable to provide employees the travel allowances and food coupons for each month.

These allowance amounts are enclosed with salary and depicted in the payslip. It is important for the company and the employee about the payslips information since they are used to procure various bank mortgages for the employee and have a record while filing the monthly taxes.

Odoo platform allows the user to generate payroll with allowances included in them. The platform allows users to set the rules of calculation about the salaries and parameters.

To set the salary parameters and allowances for an employee

The salaries for every employee in Odoo is based on several parameters set in the contract allocated to each employee. Parameters set are based on the basic pay package developed in the contract and adds allowances for each respective employee.

Basic pay is set based on the level of employee operation within the company, considering the work nature, educational qualifications, experience and so on.

This platform allows the user to post employees to work under contract for the company and to watch the employee being agreed upon the salary in the terms and conditions of the contract.

For setting the salary payment parameter of an employee in the odoo payroll module of the platform, you can select the respective employee on which the payroll parameter has been set. From the employees, the window selects the contracts icon that displays the user about the employee contract information.

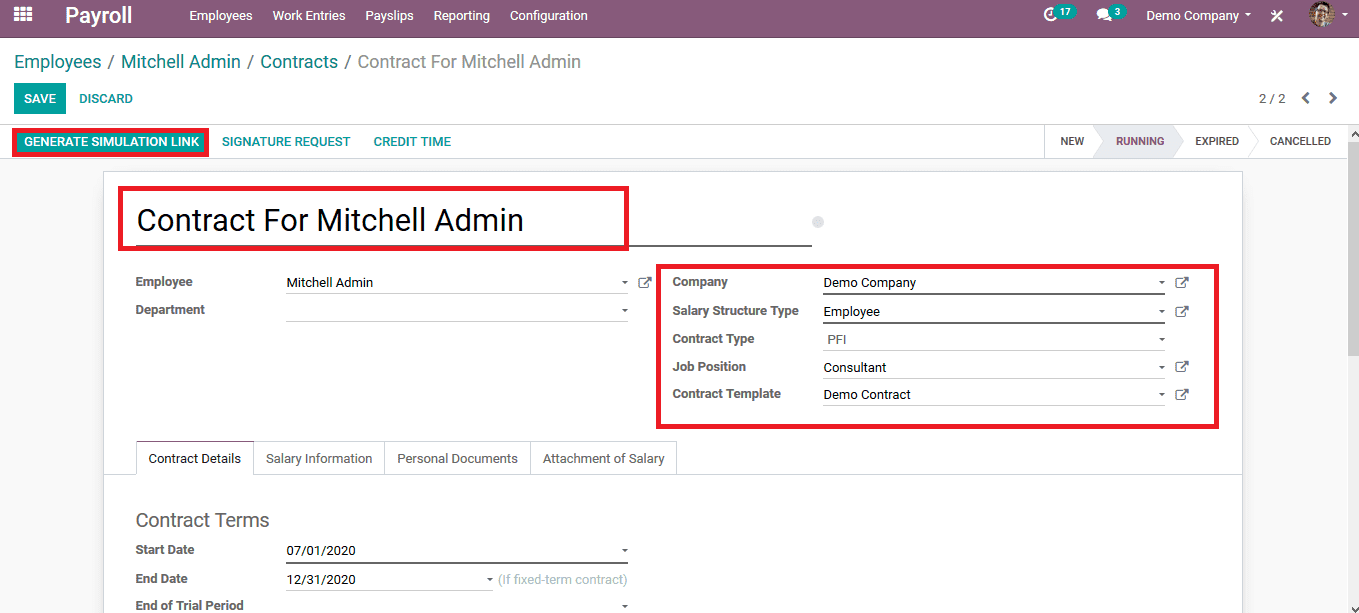

By selecting the contract icon in the employee menu, the user gets directed to the window. Then select the respective contract to which the salaries are accounted.

By selecting the respective contract the user will be redirected to the respective contract window that provides all the contact information.

The user can now view the contract name and the company allocated to it. The user could choose the salary structure type from the structures listed in the module.

The user could also provide the job position on which the employee is recruited for and the contract template can also be allocated.

In the contract details section, specific details of the contract are mentioned. The working schedule of the employee is mentioned in which the employee salary would be calculated.

The working schedules vary from country and region of operation. The HR responsible are assigned and the duration of the contract details are mentioned.

On the salary information menu, the user could provide the details of the salary. The wage is provided and additional allowances such as fuel cards, meal vouchers, and representation fees can be provided. Yearly advantages and the monthly benefits can also be provided.

The user could now generate the link containing all the contact information to be sent to the employee who is to be hired. The contract information is shared through email and the employee will be provided with all the details as they can accept the offer or reject it.

Managing payrolls for all employees

Managing the payrolls for the employee are done accurately by briefing the off times and approved vacation times for each employee.

The user could vial the options work entry in the payroll module that depicts all the information related to attendance and the off days of the employee. By selecting the respective employee, the user could view all the conflicting errors that had appeared in the month.

The user filters all the conflicting information by selecting the conflicting option in the filter menu. The user views all the conflicting information related to the month irrespective of the employee. The user can note they only generate the payslip after clearing the conflicting attendance entries available for each employee.

You have to select the respective conflicting date on which the user will be depicted with a pop-up window. The user either validates the request and saves them, or refuses the time of the request, in both cases the conflict will be resolved.

By clearing all the conflicts available in the payroll section, the user can now generate the payslip for every employee by selecting the generate pay slip option available in the window.

When generating a payslip, it lists out for the specific month and the payslips are allocated with the entry that can be viewed by selecting the payslip option.

The salary slips for employees

The salary slips provide all information related to the month’s salary details that include the allowances and pay cuts that have occurred. This also provides the user and the employees with proper information on the time off, attendance and the sick leaves taken by each employee during the particular month.

The user could view the payslip from the work entry menu of the specific month. Whereas for the employees it gets depicted in their dashboard or gets mailed them through email.

The payslip records are the important source of the report that helps the user to verify them in future instances. In the case of employees, there may be instances when they apply for personal loans or mortgages where they should provide proof of their salary, then this payslip could come in handy.

You can select the respective employee from the work entry of the month and the menu. All information related to the month’s work and the reference numbers are provided. The user could view the worked days as well as the inputs menu to view the attendance of the particular employee for the respective month.

By selecting the salary computation menu, the user views all the allocation of the total salary to the employee. This provides the user with clear cut information on allowances, salary structure and tax information.

The payroll in Odoo helps the user to manage the salaries, generate payslip, compute them based on parameters, and allow the records to get documented and reported on.

Tags: Payroll Management, Payroll Management System, Payroll Management System in Muscat

Request a Demo !

Fill up the form form below and get a affordable quote or you can call +96899030174